Reefer Market: April (Wk 13-17)

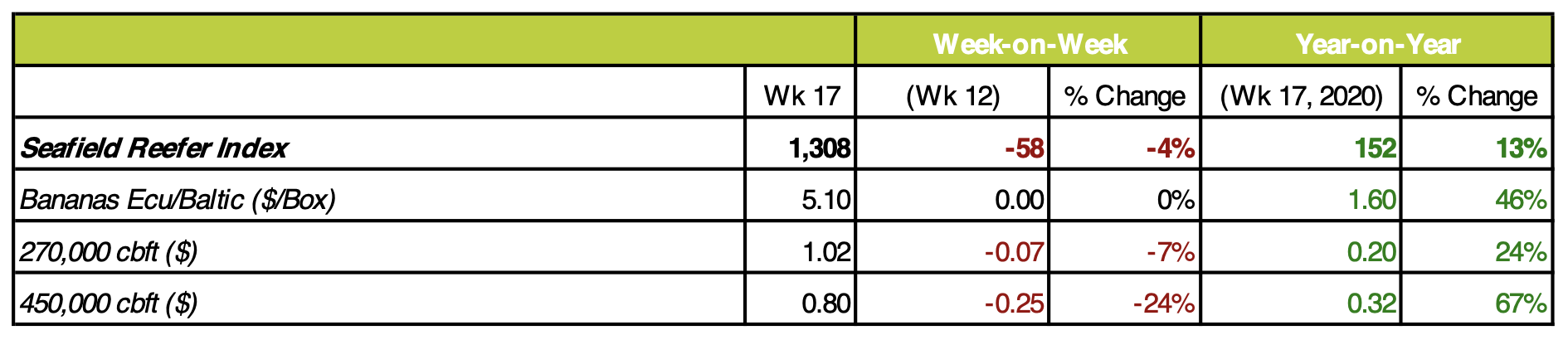

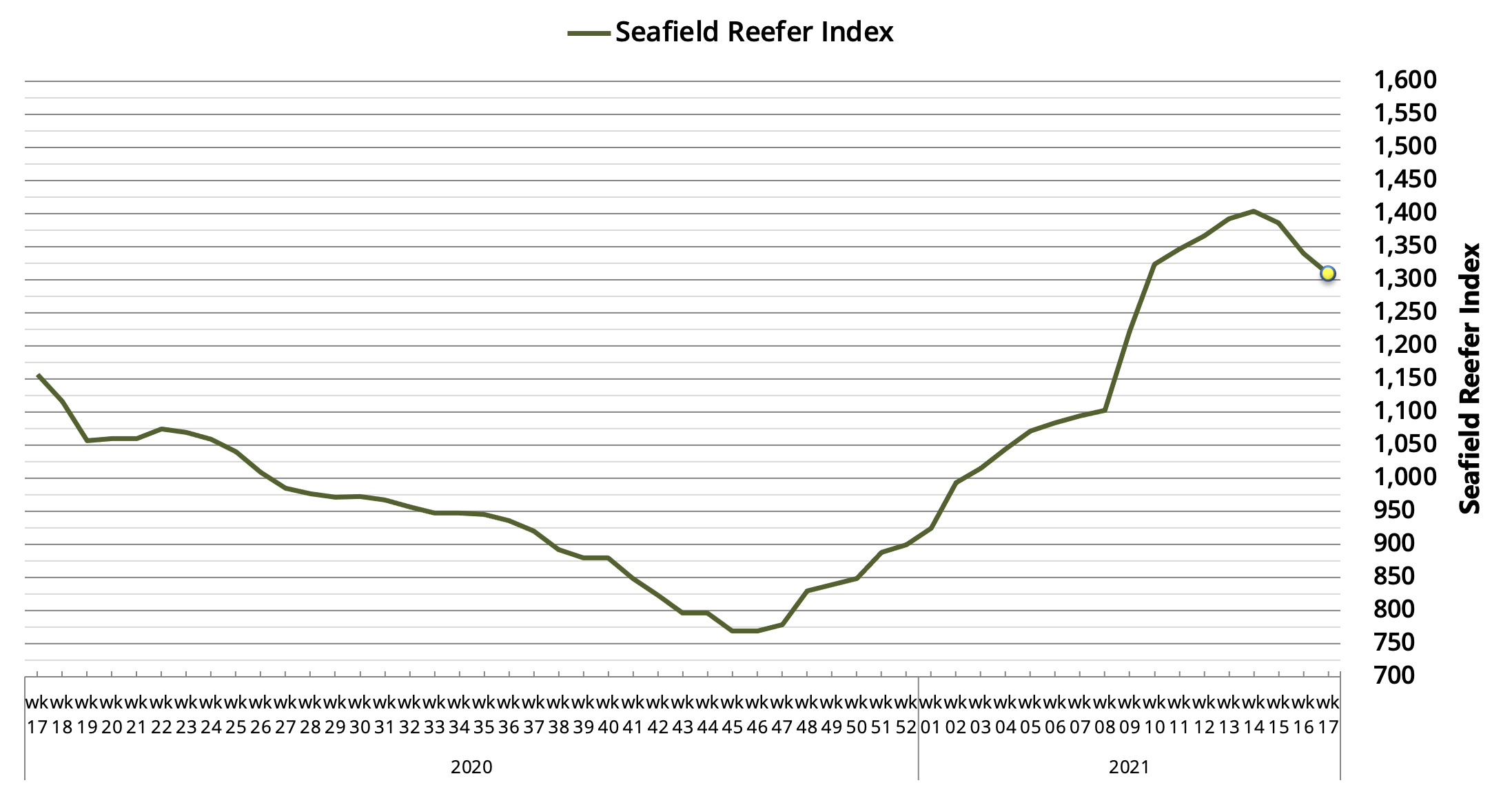

Seafield Reefer Index

Squid ties up the Market

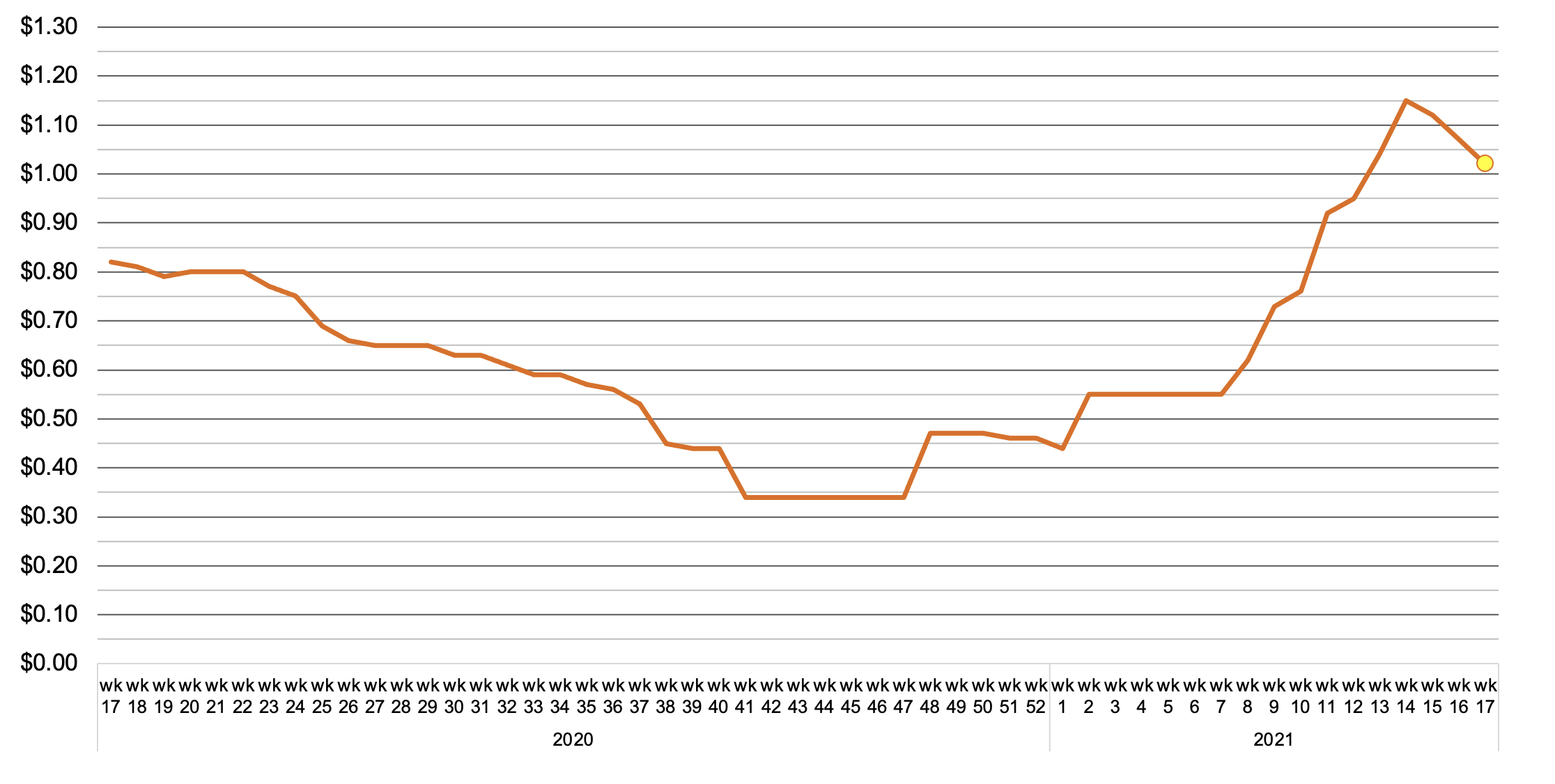

A correction in the market was to be expected in April, following the armada of reefers ballasted to the High Seas off Argentina and the Falklands during the first quarter. With the fleet near full employment, chartering activity was forcibly slowed-down, as tonnage eluded several enquires. Owners meanwhile continued to ride the wave of optimism from the TC returns being commanded in the squid trades, with some Shippers holding-back on coldstore cargoes as a result, until the market sobered-up. Following a 50% surge across the first quarter, our ISB Seafield Reefer Index took an adjustment during April, down 58 pts (-4%) to close at 1,308 pts.

There continues to be weak demand from the Mauritanian fishing grounds, which once again have taken a back-seat to the clamour for tonnage in other Atlantic trades. Trawlers have struggled to bring in full loads for transhipment leaving many of the independent Owners to pick-up the scarce volumes, with rates rarely being tested in a competitive setting. In years past, this feeble demand would have caused market-wide reefer rates to plummet for < 400k cu.ft. vessel’s, however the sheer volume of tonnage committed into Squid so far this year has kept the West African fleet slim and in most cases fit-for-demand. By the close of week 17, over 25 reefer vessels from the spot trades had been committed to South Atlantic squid – more than double the previous season’s fleet – which accounting also for the slow discharge speeds in the Far East, where Pusan remains heavily congested, will mean that rates in the Atlantic trades are likely to remain supported, with a constrained supply of vessels in the near-term.

Even as the squid catches have become more elusive – with the Falklands seemingly reaching a conclusion – there’s been little concern from Owners who continue to have cargo interests blocking up their phonelines. The almost seamless transition to the New Zealand Kiwi and South African /Argentinian citrus exports for larger reefers has kept this tonnage mostly off the spot market, which for the Blue Whiting trade out of the Faroes, has ensured a healthy demand for the smaller freezer tonnage, with a high percentage of cargo once again shipping to Nigeria on longer-haul voyages, as opposed to the Baltic. On an especially promising note for the reefer trades, Walvis Bay and Angola appear to be back in the fold, after some time in the wilderness. For Angola, this is a most welcomed development. Reefer activity has been restricted to 1-2 vessels running volumes from the fishing grounds in the south to Luanda for discharge to the local market over the last year, however trawler activity is ramping up, with 8 factory trawlers now on the fishing grounds and promising signs that exports to further afield in West Africa will again resume.

Outlook:

With the slowdown in squid over the last two-three weeks, the question is, has the market peaked? While it’s still possible that late season cargoes will be fixed from the South Atlantic, it is more probable that other trades will prop-up freight-levels. For mid-May there is already a shortage of tonnage for the West African market, with positions likely to go unfilled just as the catches off Mauritania begin to report some substantial improvements.

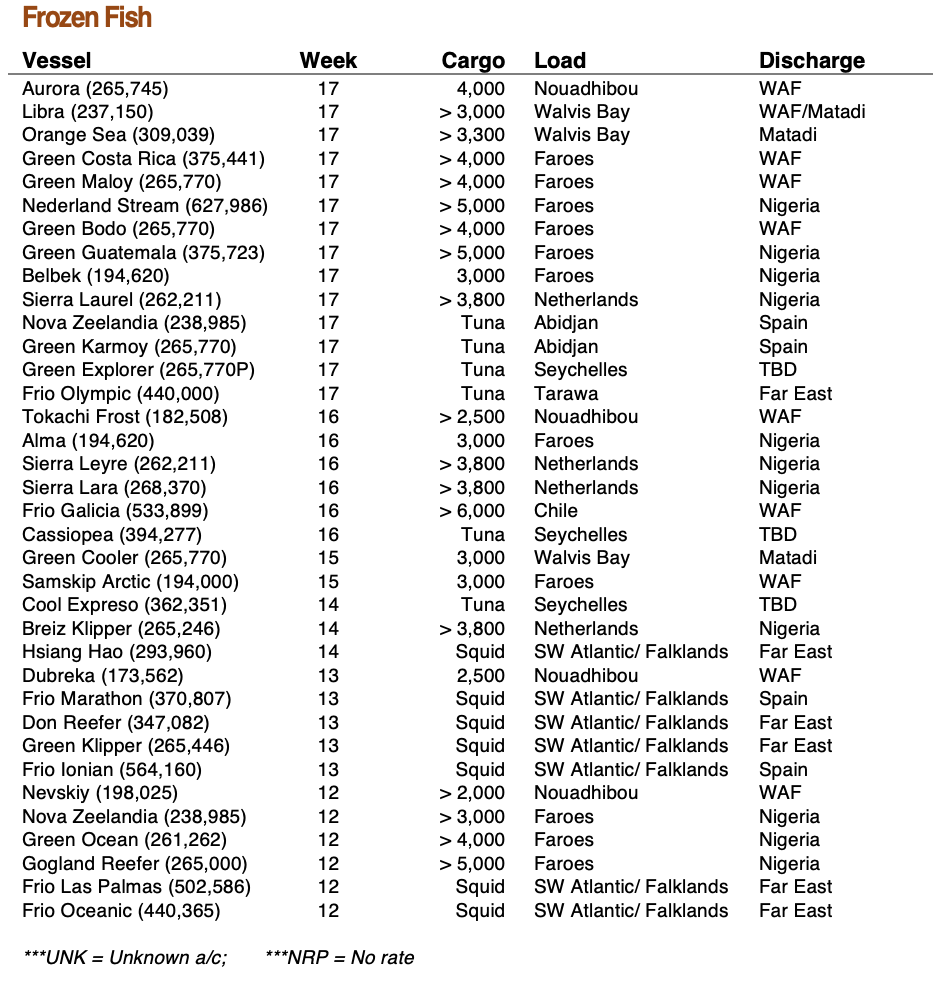

Select Fixtures from Wk 12-17:

Seafield Reefer Index

270,000 cu.ft. TCE returns