Reefer Market: August 2020

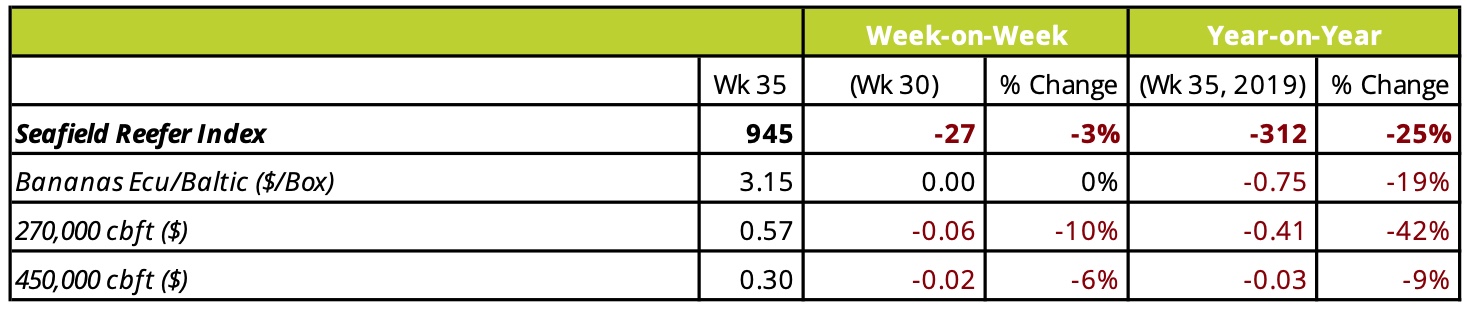

Seafield Reefer Index

Under Pressure.

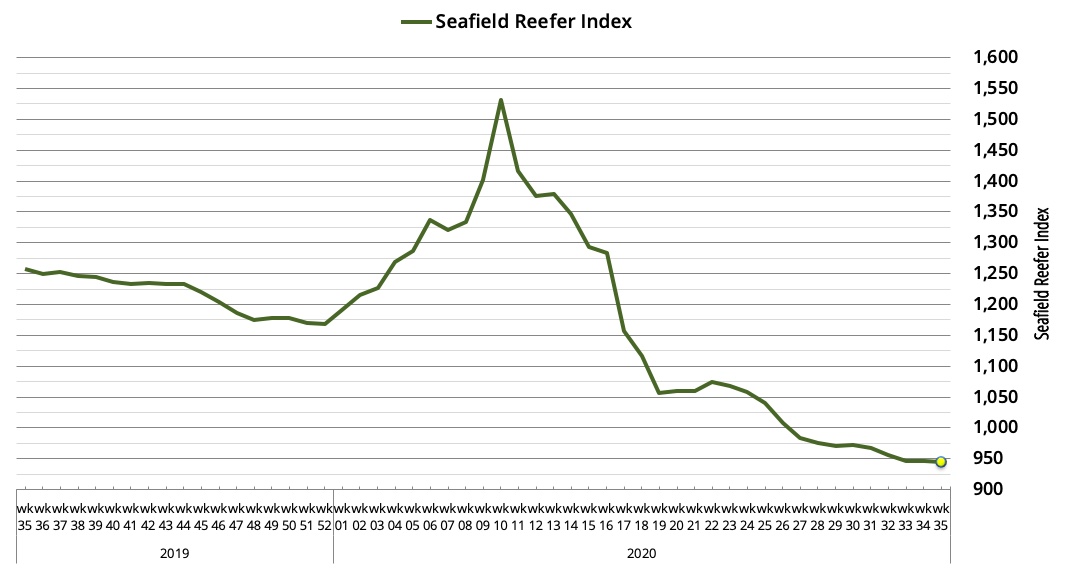

A quiet month on the Chartering front was reflected in lengthening spot tonnage lists for Reefer vessel’s off West Africa, where Owners have struggled for cargo. Glimmers of promise from the Faroes Mackerel and South African citrus seasons were not enough to pull our ISB Seafield Reefer Index back above the symbolic 1,000 point mark – instead closing down 27 points across the month at 945 points.

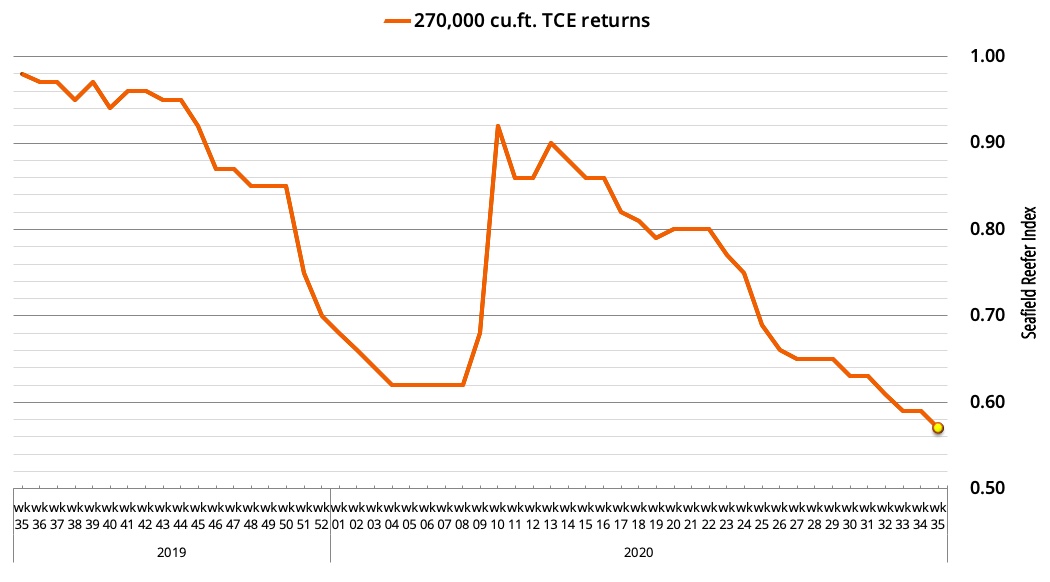

Scales tipped further in Charterers’ favour across through August in the frozen trades as the steadily building oversupply of reefer tonnage in West Africa squeezed rates down to $10 per mt on average by the close of week 35 – roughly $50 per mt down year-on-year for the month. Trawler catches off Mauritania have been poor overall, with estimates of volume down 30-50% year-on-year at various periods during the month. The longer cycle between transhipments has left reefer’s queuing at Nouadhibou roads. Demand from Morocco traditionally kicks-in during weeks 30-33, but volumes have also been sluggish, with the season still under a large asterisk. No final agreement has yet been reached for Russian quota in Moroccan waters, leaving just the handful of EU-flagged trawlers to drive reefer demand off Dakhla for the time being, while the Russian fleet eagerly awaits further developments.

Disillusionment hasn’t engulfed the marketplace however, with North-Atlantic Mackerel building on its early season promise to provide a consistently healthy demand for reefer tonnage through August. In the first instance, this demand from the Faroes and Netherlands has been filled by tonnage ballasting from Las Palmas-Nouadhibou, giving a much needed spread of the fleet which has slowed the wider decline in rates. Catches gradually suited more the Baltic markets as the month progressed though, keeping ton-mile demand for reefers in check as fewer vessels were needed for the shorter-haul trades, especially with Baltic/Cool cutting-cubic to offer their parcel service from Faroes, which suits perfectly to their vessels discharging end of season citrus or bananas into the Baltic.

Shifting focus to these fruit trades and larger reefers, on a superficial level it’s been a month of very little to report with freight levels plateauing and few notable spot fixtures worth mention. Underlying this calm façade however, Owners have been enjoying a bountiful citrus export season from South Africa throughout the summer, with healthy contract volumes stretching the > 450k cu.ft. fleet to its limit at times during weeks 31-33. A slow re-emergence of banana spot chartering has meanwhile stabilised the market through the remainder of August as citrus and kiwis from the South dried-up.

Outlook:

Double-digit open tonnage lists off Las Palmas – Nouadhibou look set to continue through the opening weeks of September as near-term prospects for the frozen trades hang on the outcome of Russian access to the Moroccan fishery. Positively there has been a return of Namibian cargo to the spot reefer market after a lengthy absence of more than two months, which if sustained will help alleviate some of the pressure currently faced by Owners.

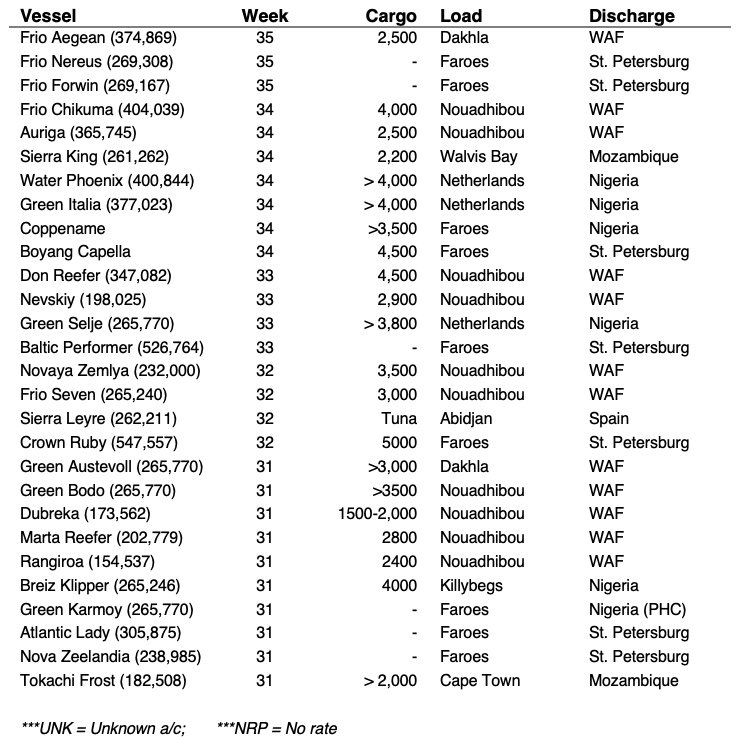

Select Fixtures from Wk 31-35:

Seafield Reefer Index

270,000 cu.ft. TCE returns