Reefer Market: Wk 07-10

Seafield Reefer Index

Imperfect storm causes reefer market to soar to 5 year high.

Rates have surged upwards across weeks 06-10 as reefer tonnage filled the vacuum left by the chaos that has developed in the container market as a result of the Coronavirus outbreak. With the addition of a sudden and sharp upturn in squid demand, the market is firing on all cylinders and our ISB Seafield Reefer Index spiked up 195pts to close at a five-year high of 1,531 points by end-Wk 10 the highest level since early 2015.

Having taken a back-seat for January and much of February, the frozen segment shot to life during weeks 09 & 10 as the unpredictability of squid catches in the South Atlantic came to the fore, while blue whiting and remaining Mackerel from the North Atlantic swept up the balance of lingering tonnage. Reported daily squid catches by jiggers rose from < 2 mt per day to upwards of 40mt per day towards end-February, catching reefer Operators very much by surprise. Up to this point, just a small number of Chinese/Taiwanese and a couple of Laskaridis reefers were committed to the Fishing Grounds, but over the last two week period, approx. 10 vessels have fixed to load S.W. Atlantic/Falkands, most ballasting from the Atlantic eastern seaboard. Such was the shortage that GreenSea/Seatrade were called on for tonnage – fixing three vessels at incredibly strong levels reported to be in excess of TC $1.10/cb.ft. bss 90-days, their first vessels in S.W. Atlantic squid for three years.

Congested coldstores in the North Continent and a robust start to the Faroes blue whiting season meanwhile cleared all > 260,000 cb.ft. vessels off the shelves in the North as the knock-on effects of the Coronavirus in the containership trades began to take effect. A large degree of coldstore volume in Ireland/Holland has by necessity switched mode into conventional reefers, since a significant proportion of reefer boxes remain stranded in China following the Coronavirus outbreak. Combined shipments from Faroes/Ireland/Holland into West Africa across weeks 06-10 have totalled approximately 65-70,000 mt – a 15-20,000 mt (one-third) increase over the same period last year. Although volumes further south off Moroccan/Mauritania have been less impressive, rates have nonetheless risen on this tide of buoyant sentiment, as well as almost all surplus tonnage off Gibraltar-Nouadhibou sailing to the S.W. Atlantic or North Continent.

For larger reefers engaged in fresh trades, the spot Charter market has been quieter but no less striking. As the extent of the reefer box shortage became more apparent towards end-February, and liner Operators applied surcharges of upwards $1,000/box to combat congestion and lack of available plug-in points in China, conventional reefer tonnage was ideally primed to gain from the chaos that the Coronavirus has wreaked so far in the container market. Gain it did, with timecharter returns almost doubling since January. The only dampener for Operators has been the lack of readily available spot tonnage and a fleet already at near full employment.

Outlook:

It’s difficult to see rates going anywhere but up in the near term as Charterers across all trades begin feeling the effects of the fleet being stretched to its limits. At best estimates, it will take several months before reefer box positioning is back to a semblance of normality. Meantime, in the North Atlantic the Faroes-Holland range is all but sold out of > 260,000 cb.ft tonnage for the next 10 days, while larger NEAFC tonnage is also scarce through the remainder of March with potential candidates being drawn in by the sudden squid demand.

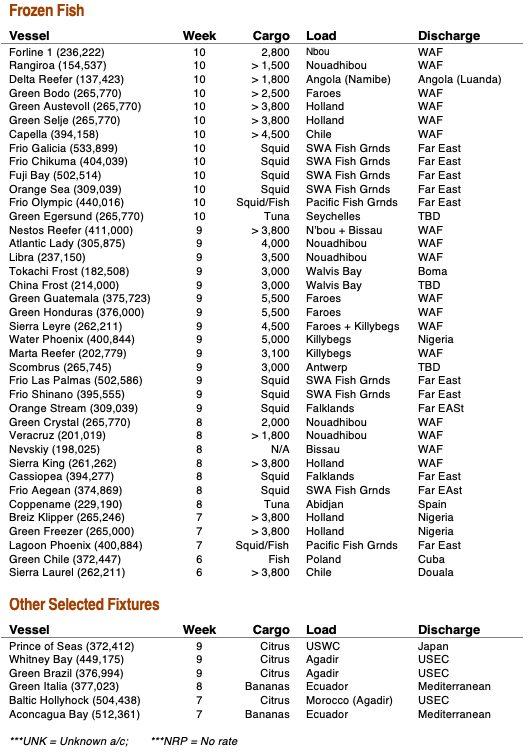

Select Fixtures from Wk 07-10:

Seafield Reefer Index