Reefer Market: February (Wk 05-08)

Seafield Reefer Index

Squid marks the market direction…

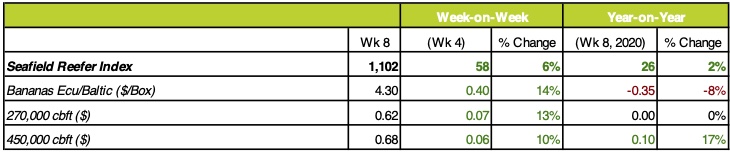

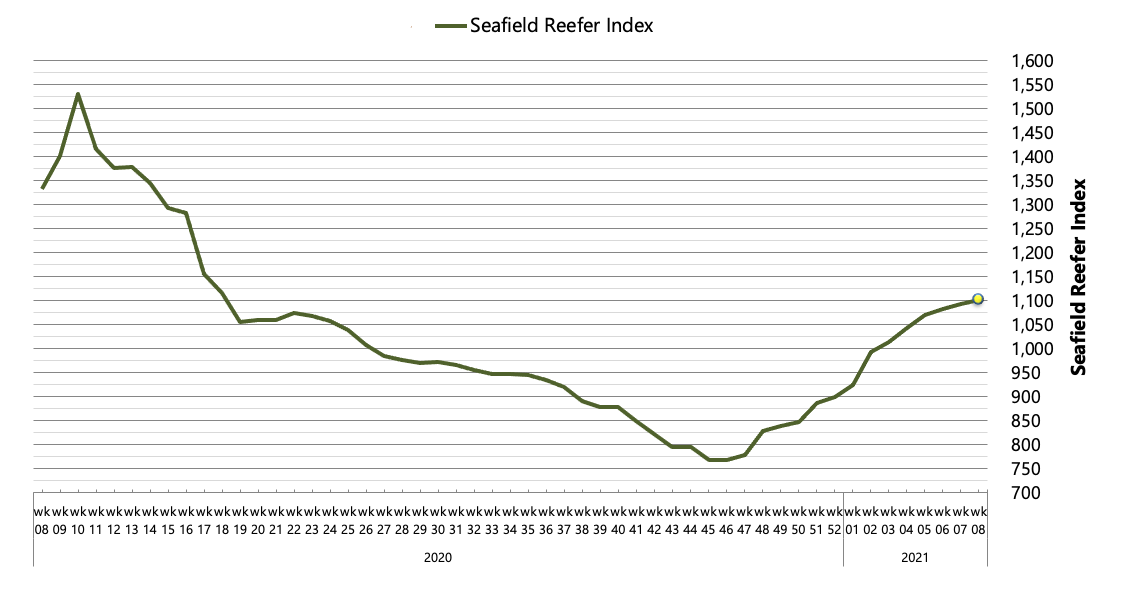

Demand from all corners of the market as traditional peak season trades intersected with the ongoing reefer box shortages has given both fresh and frozen trades a boost through the month of February. Grape, banana and squid trades have slashed the availability of > 400k cb.ft. vessels, while the start of the North Atlantic’s blue whiting season is slowly re-balancing the handysize fleet, providing Owners with a bullish outlook as new enquiry shows no sign of slowing. Our in-house ISB Seafield Reefer Index rose 6% across the month of February to close at a 10-month high of 1,102 points.

The slow drip-feed of cargo from Mauritania into the marketplace has been a predominant feature of the frozen reefer trades for a number of months now, and with status quo remaining through February (averaging a single vessel per week), the drivers of freight levels and supply dynamics have largely been determined by trades further afield. Grabbing many of the headlines – for better or worse – has been Russian Far East catches, shipped mainly via Chinese/Korean ports where the lack of reefer containers has prompted a noticeable shift of cargo into conventional tonnage since the end of 2020. Ingenuity has been the buzz-word as Charterers and Owners alike navigated port closures, stevedore quarantines and lengthy queuing to try clear the bottle-neck of building herring volumes in Chinese and Korean coldstores, into West Africa. Owners have been well rewarded with rising freight levels, however congestion and the lack of spot vessels in the area has brought fixtures to a halt for the time-being.

At any other time of the year, Owners may have ballasted more vessels into the Far East, but with the Chilean fruit exports and increasing spot banana demand helping to keep the > 450,000cb.ft. segment near full employment and the South-West Atlantic Squid trades absorbing much of the spot 350-450k cb.ft. fleet, the larger size-classes have not been short of cargo, and this has reflected in the rising returns commanded by Owners in recent weeks.

For its part, Squid is sticking to the narrative and, for the time-being at least, showing increased year-on-year catches once again with 12 vessels from the Laskaridis/Lavinia fleet already committed to the region, versus just 5 at this point last year. Biomass regeneration is projected to be gaining pace and these improved catch volumes are good news in the longer run, as the trade looks to be continuing its upswing towards the next roughly eight-year cyclical peak in 2023.

Outlook:

Near-term signals indicate a tightening of supply and rising rates on the horizon for the frozen trades. Entering March, FSC-Frigoship are all but sold-out of tonnage making it a battle between GreenSea and the independents for much of the volume into West Africa. The trickle of tonnage ballasting past Mauritania/Morocco into the North Continent for Dutch contract shipments and spot orders from Norway is set to become a stream as the first Blue Whiting loadings from the Faroes are now taking place drawing vessels north. With a pick-up in demand from Tuna Charterers in the Indian Ocean and more vessels seemingly required for the South-West Atlantic, the fleet is stretching increasingly thinner.

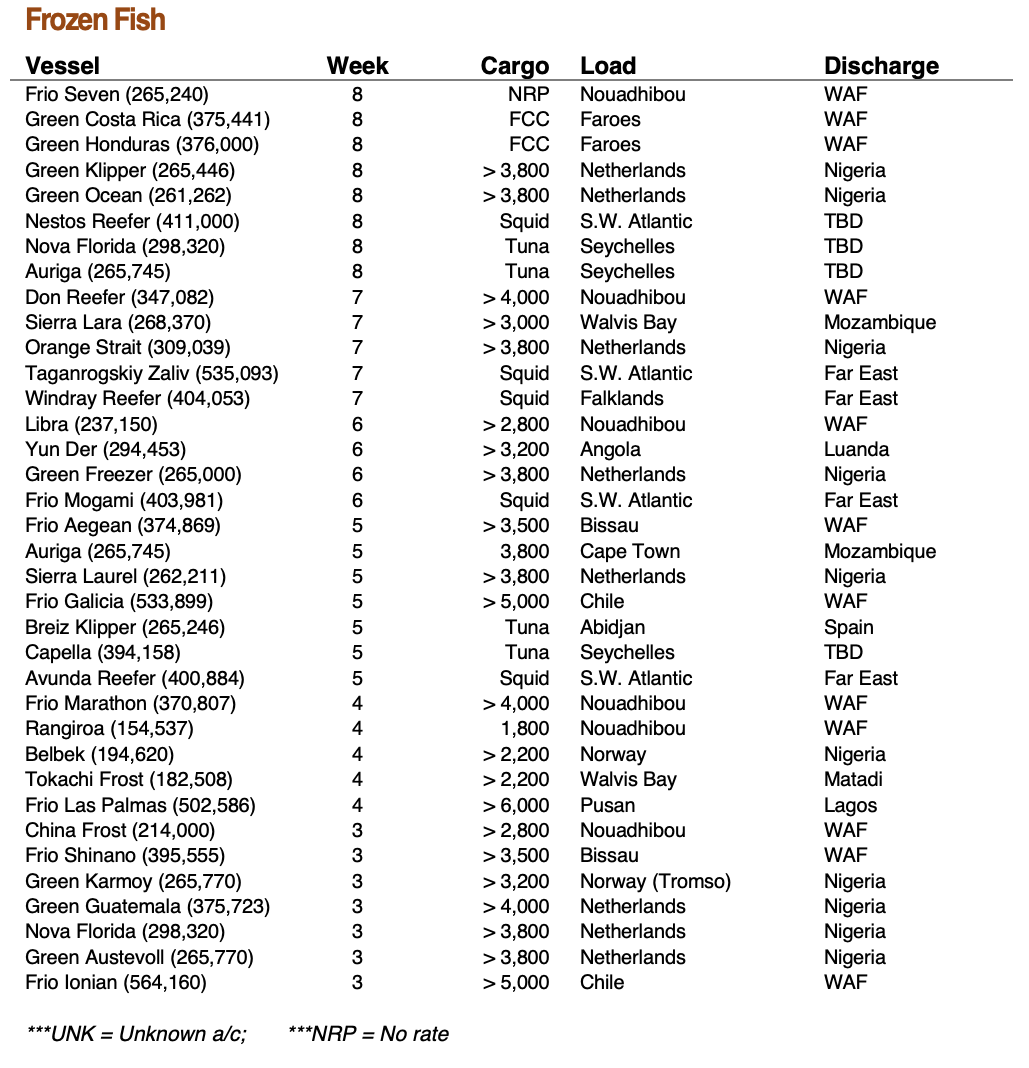

Select Fixtures from Wk 05-08:

Seafield Reefer Index

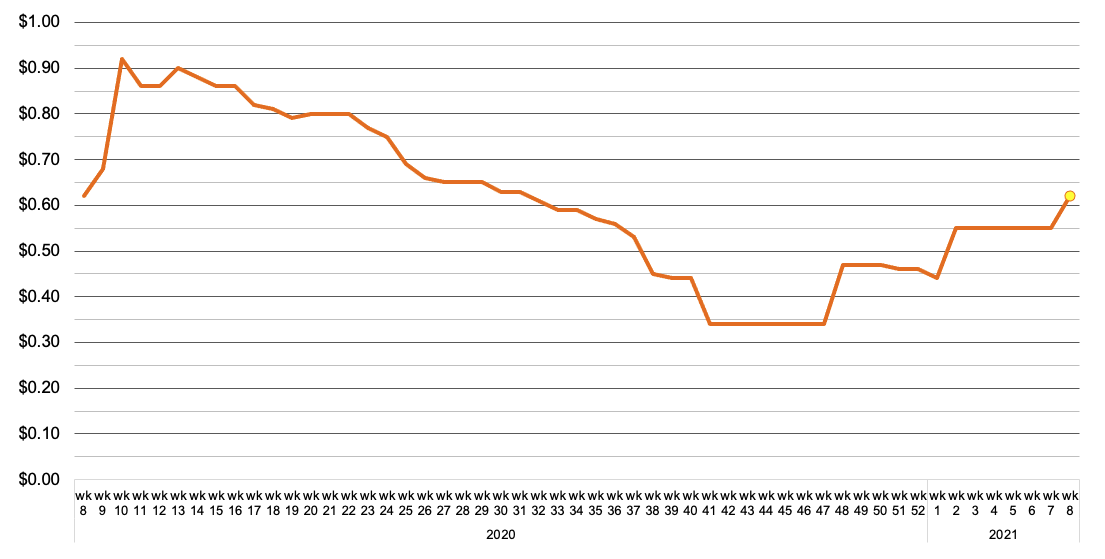

270,000 cu.ft. TCE returns