Reefer Market: July 2020

Seafield Reefer Index

Under Pressure.

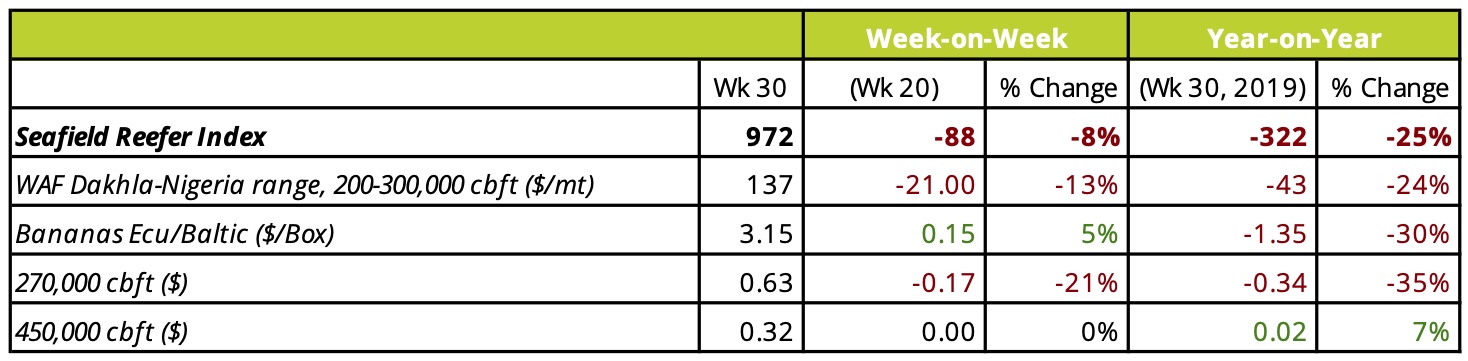

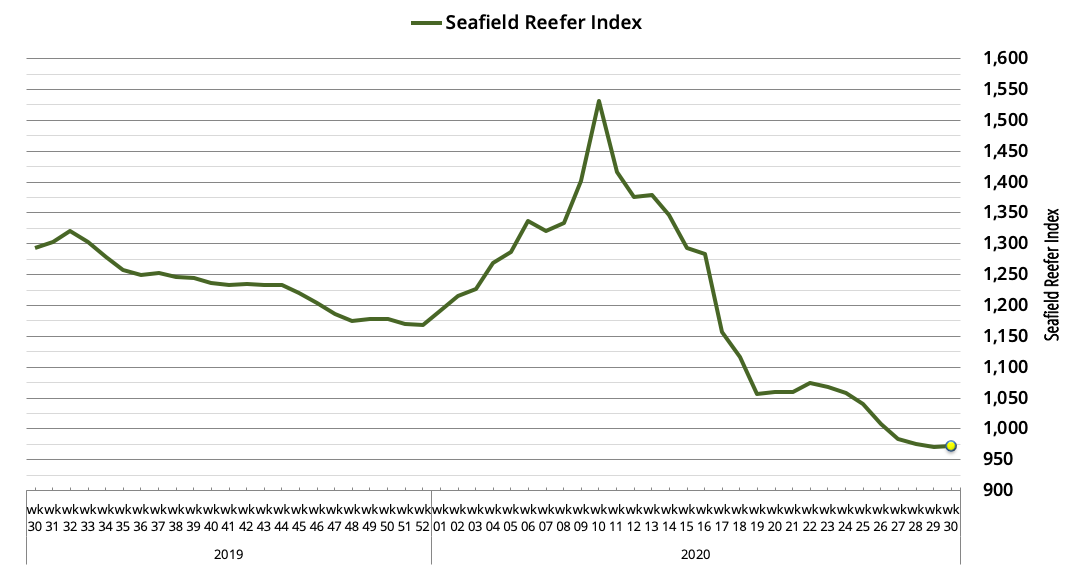

A slowdown in frozen volumes across June and into July combined with a lengthening spot list has caused rates in the Handysize reefer segment to continue sliding. OPEC’s output cuts and the slow recovery in crude prices since mid-April has meanwhile increased average bunker costs by approx. $120 per ton – hitting TCE returns – while being devoid of any major upturn in global energy demand or trade as many regions remained entrenched in the lockdown phase of Covid-19. This has led our in-house ISB Seafield Reefer Index to slip below the 1,000-point barrier for the first time in almost three years, closing July at 972 points. The push and pull in the market has left the Owners under more pressure at this time of the year than for the last 2 years.

Surplus tonnage (5-10 vessels per week off LPA-Nbou) through the later part of June and into July has been characteristic of the frozen reefer trades which after the promise of late-season squid and improving catches off Mauritania in end-May have succumbed to quieter trading in recent weeks, with benchmark rates now down at $137.00 per mt basis 3.5k mt into Nigeria. Catches off Mauritania through June and into July have shown sparks of promise, however they have proven too inconsistent and sporadic to provide the necessary sustained demand to keep an increasing supply of 200-350k cb.ft. reefer vessels in the region fully employed. The surplus has been in part triggered by redeliveries from other end-season trades, most notably squid vessel’s from the Far East returning to the Atlantic, but also GreenSea vessels exiting the Egypt-Black Sea trades that had occupied several units up until mid-June.

Blue Whiting shipments from Faroes into West Africa has remained a mainstay of the frozen trades during this period and kept freight levels from tumbling further by drawing tonnage to the North for these longer-haul voyages. With an estimated 95,000+ net mt shipped across Jan-Jun (on 25 vessels), this years’ Faroes-WAF blue whiting season has built on the previous years’ improvement of 85,000+ net mt and consistently drawn on ballasting tonnage from Med/WAF to slow the decline in the freight market. Through early weeks of July, the changeover from blue whiting to mackerel off Faroes has been almost seamless, with little sign of the lengthy break that traditional punctuates this transition. This has prompted almost 15 reefers to ballast north to the Faroes over the last four-week period – from as far south as Matadi – to carry the first of the North Sea Mackerel cargoes; a positive early-season sign.

Elsewhere looking to the fresh trades, there’s been improvement in fruit volumes from South Africa, Argentina and New Zealand over the last number of weeks, and while trading conditions for the segment have remained challenging compared with the spike in demand from earlier in the year (particularly for bananas and the weak import market in the Med), the lingering reefer container shortages and an added boost from several larger units fixing frozen fish cargoes from Alaska into the North Continent has lessened the overhang of spot tonnage compared with frozen trades. Operators of > 400k cb.ft. tonnage are therefore pushing for last done freight levels as the market has steadied itself.

Outlook:

Vessels have been clearing quickly through West Africa discharge ports in recent weeks as rains have subsided and congestion at Lagos eased. 5-10 spot reefers off Las Palmas-Noudhibou are expected over the coming 7-10 days and with the major boost from the first Faroes Mackerel volumes now run it’s course, Operators are looking to creative options for employment before the next TS cycle in the North, including quoting for citrus cargoes from South Africa and Argentina.

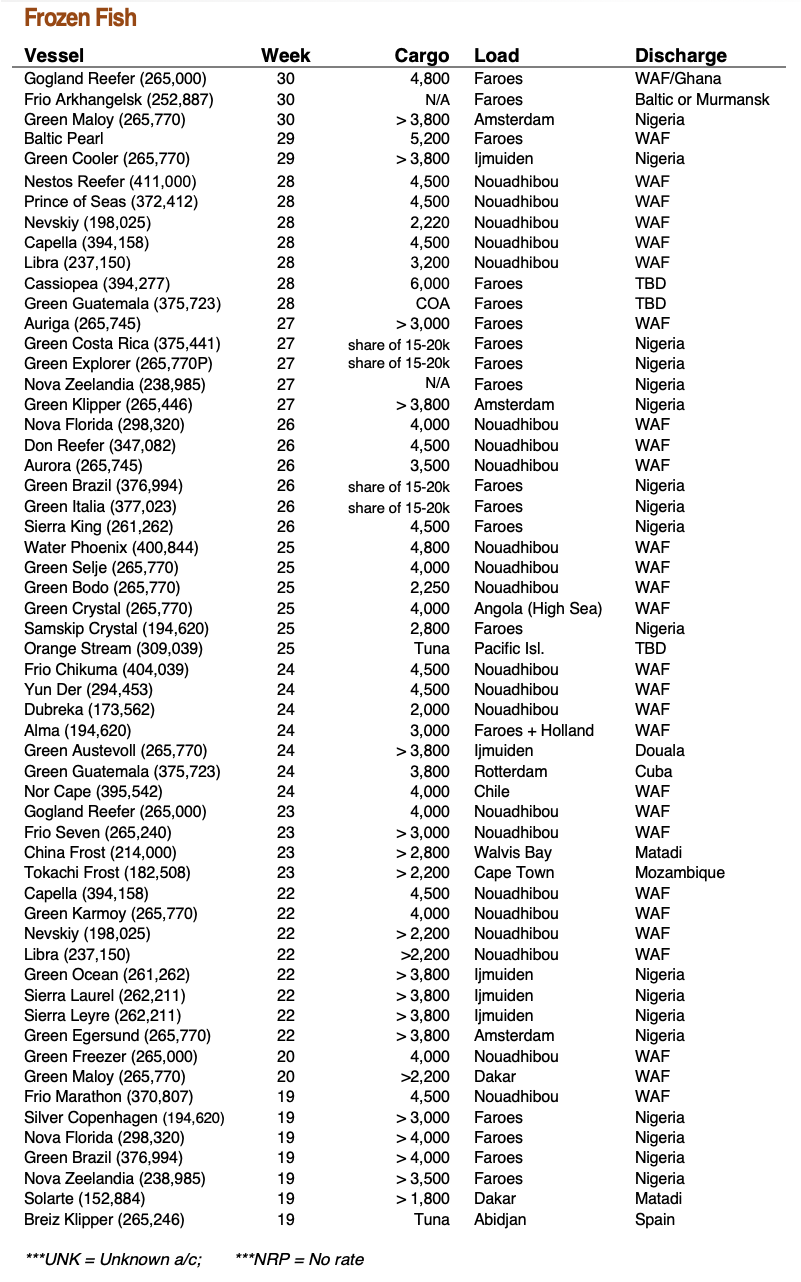

Select Fixtures from Wk 21-30:

Seafield Reefer Index