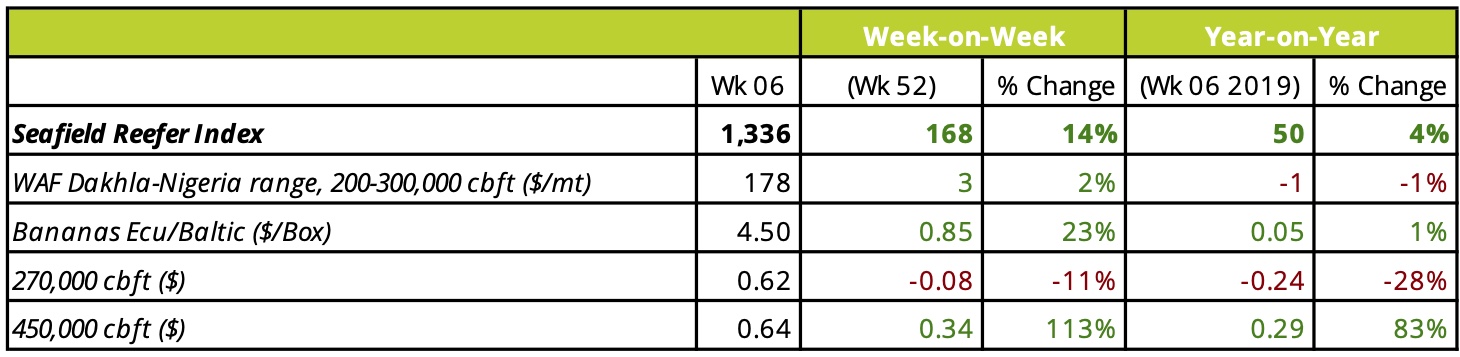

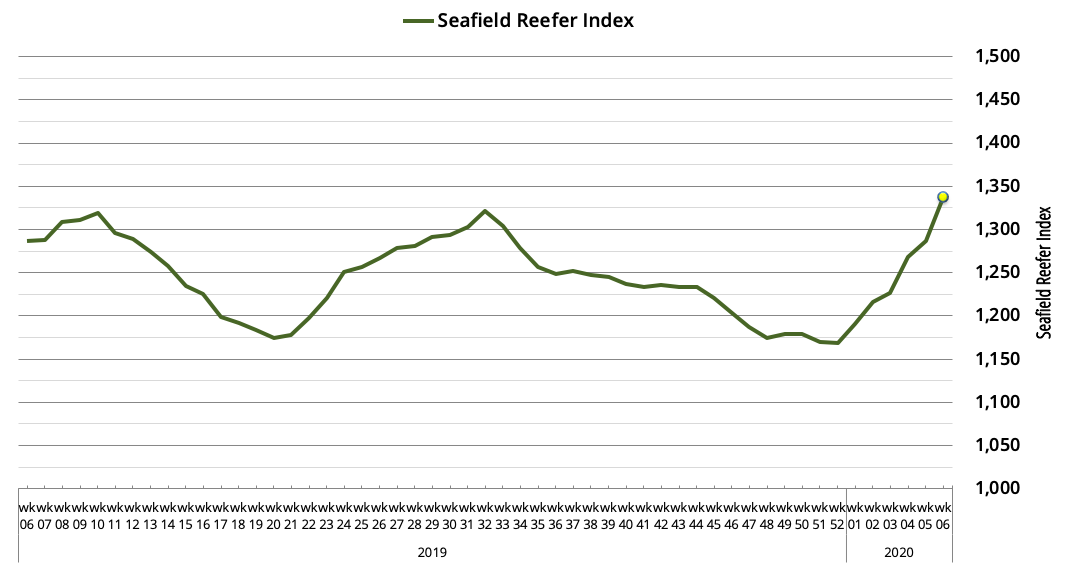

Reefer Market: Wk 01-06

Seafield Reefer Index

Northern Lights Shine on Faroes…

The story of 2020 so far has been bullish fruit markets (especially bananas) – which have drawn in much of the mid/larger-size fleet from the relatively more subdued frozen trades, giving Operators some respite as they await the next big push in the fish markets from the blue whiting season starting mid-February.

In a carbon copy of previous years, fishing off Mauritania and Morocco started the year poorly, with smaller independents offering on the business that was there, resulting in a low fixture count, a ballooning spot list of off Las Palmas by mid-January (12-15 vessels at one point) and general downward pressure on rates – a situation further compounded by vessels exiting the seed potato trades too early to fix straight into blue whiting from the North. However, unlike previous years – and despite these pressures – there has been no sharp downward correction in freight levels and bananas have been the main cause.

Through the closing months of 2019, spot banana cargoes were scarcely seen circulating in the marketplace. A combination of reefer box shortages and strong early-season demand from the Chilean fruit exports has turned this on it’s head however. By early-January the ‘larger’ fruit-carrying reefers were all fixed until start-February dates, while Seatrade’s fleet was sold-out until week 08! With larger vessel’s such as the Island-types (Charles, Barrington etc.) which had been lingering spot now taken on long-term TC’s as well, the banana market turned to the mid-size 300-450k cb.ft. reefer segement to meet its tonnage needs. In turn, this absorbed much of the excess tonnage that would have idled off of Gibraltar-Las Palmas through January/February, helping freight levels to slowly creep upwards.

Elsewhere, Peruvian squid requirements into the Far East have served a ‘supporting’ role, absorbing several units form the Laskaridis / GreenSea fleets until end-March dates earliest, and acting as a counterbalance to the slow catches in the South-West Atlantic. Jiggers in international waters off Argentina have reported very low volumes to date, resulting in just one reefer ballasting to the region from the Atlantic’s eastern-seaboard in January. February should get busier as the Falklands catches open mid-way through the month, however the degree to which this will pull tonnage from elsewhere in the reefer market is very much under a question mark right now. Lower water temperatures combined with projections that the squid biomass will largely be inside Argentina’s 200nm zone does not bode well for reefers which rely on strong catches by the international fleet.

Outlook:

The market has gradually settled following the IMO 2020 sulphur cap imposition on January 01st. Supply of VLSFO has not been as difficult to source as many expected, while Operators have welcomed the roughly 25% drop in prices across the month following December’s spike. Fuel costs remain roughly 50% higher than before the regulation however and this will be a factor throughout February as Operators continue to aggressively push for higher levels to mitigate this. In the frozen trades, Operators have so far been unable to pass most of this cost on to the Charterers, however strong early-season interest from blue whiting combined with Mauritanian and Moroccan volumes showing an upturn will no doubt provide them with renewed enthusiasm. For week 07, supply of tonnage has narrowed to 5-7 open vessels in the Gibraltar-Nouadhibou range.

Select Fixtures from Wk 01-06:

Seafield Reefer Index