Reefer Market: Wk 11-17

Seafield Reefer Index

Oil be back…?

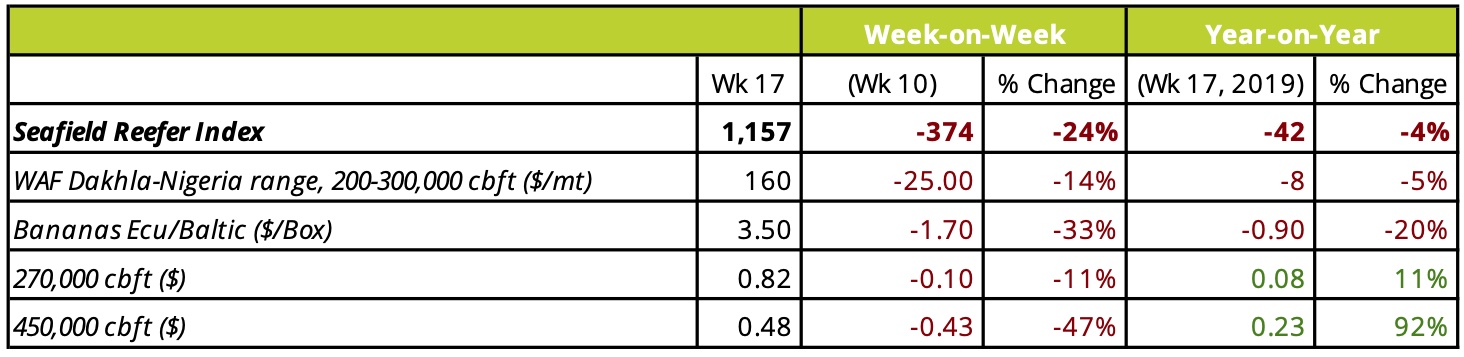

Reefers have been on a roller-coaster ride through 2020, with the last few weeks no exception. Having been one of the few shipping markets to initially gain from the COVID-19 disarray by sweeping up container volumes causing a spike in rates, their descent has been no less dramatic – and sharp. To add to the state of flux and volatility, we now have an oil price collapse. In the space of 2 weeks the price of a barrel of oil hit a 20 year low and also managed its biggest single day rise ever before quickly losing all of those gains over the following 2 days. By the close of week 17, our ISB Seafield Reefer Index was down 24% (-374 pts) to 1,157 points since its peak.

The collapse in oil markets arising from weaker energy demand from the COVID-19 pandemic has been especially destructive towards freight levels. As we saw during the last major oil collapse in 2016, there are gains for Reefer Operators – cheaper bunker prices will lower operating costs and increase their competitiveness against containerships. However, Operators are increasingly competing for a share of a shrinking market, as many of the major importers are reliant on oil revenues to stabilise their exchange rates and thereby maintain consumer buying power. Since the start of March, the Ruble was down almost -20% versus US Dollars at one point and the Nigerian Naira down a more modest -5%. With weakening purchasing power and lockdown and quarantine restriction in many of these countries becoming the new normal, demand for reefer cargoes has taken a hit.

In the frozen reefer trades demand has hit a seasonally quiet patch. After the rush in North Continent fixtures into Nigeria, the almost four-week break in the blue whiting transhipment cycle in the Faroes has combined with the continued slow catches off Mauritania (abt. 6,000 mt fixing weekly) to leave tonnage clearing through congestion in Lagos with little immediate fixing opportunities. Prospects for further tonnage needs in the squid trades have also dampened as catch reports indicate tonnage already committed to the South West Atlantic will meet near all cargo needs. But for the for congestion and curfews in several West African ports slowing discharge rates, spot tonnage lists would be lengthier and rates under further pressure.

Fresh reefer trades have seen TC returns scaling back by more than 40% on average. The source of much of the markets gains during February, the segment has struggled adapting to the shift from peak Chilean fruit trades to the South African citrus and New Zealand Kiwi seasons into April, which have failed to absorb all of the redelivered reefer vessels creating a spot tonnage list for the 450k+ reefers for effectively the first time this year. Reefer box shortages remain, particularly in South America, however Reefer Operators – even with tonnage newly in hand – have been unable to make any play, as spot trading in bananas in particular has ground to a halt with the main import market in the Mediterranean and North Continent already over-supplied due to weakening consumer demand.

Outlook:

Amidst the turbulence of the COVID-19 pandemic and struggling oil markets now seeing negative futures prices, forecasting the market’s next bend or dip is becoming increasingly more unpredictable. The back-log of spot tonnage has been slowly cleared through week 17 however, as Charterers fixed-forward requirements from Faroes and Nouadhibou, with some outliers pulling average rates down. Looking ahead to weeks 18/19, the balance appears to be shifting back in Owners’ favour as rates look set to steady/firm.

Select Fixtures from Wk 11-17:

Seafield Reefer Index