Reefer Market: May (Wk 18-22)

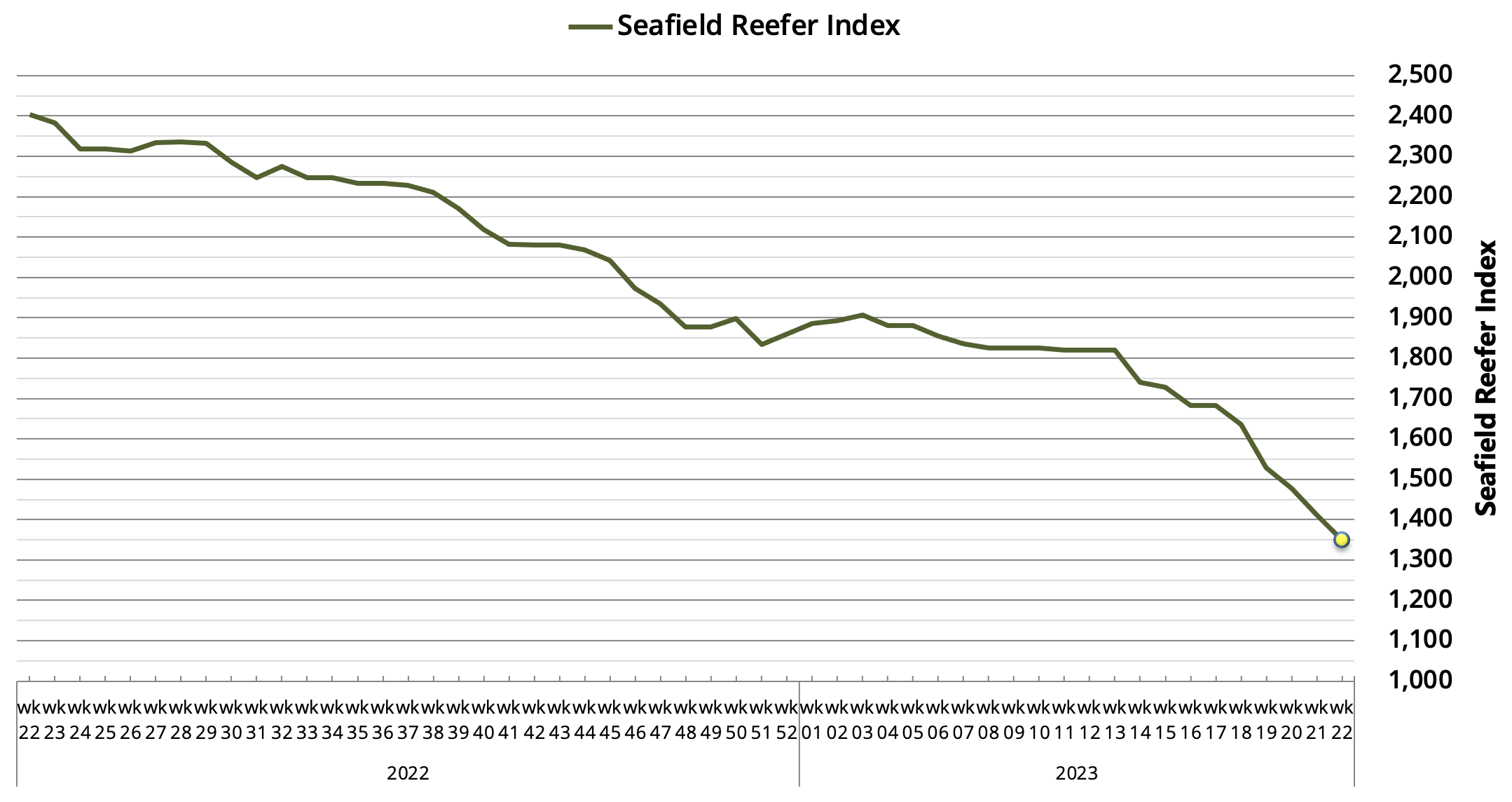

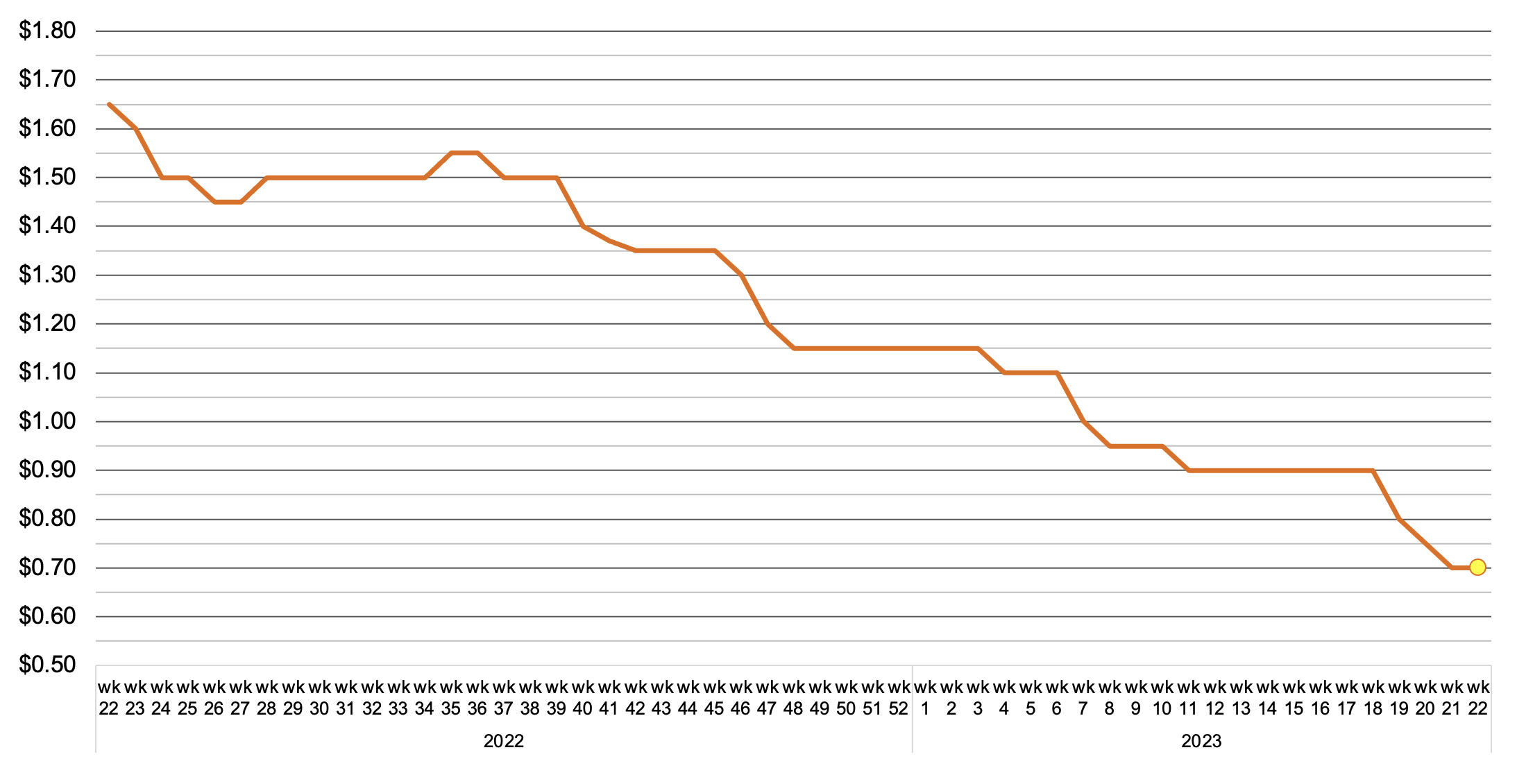

Seafield Reefer Index

Summer of Discontent

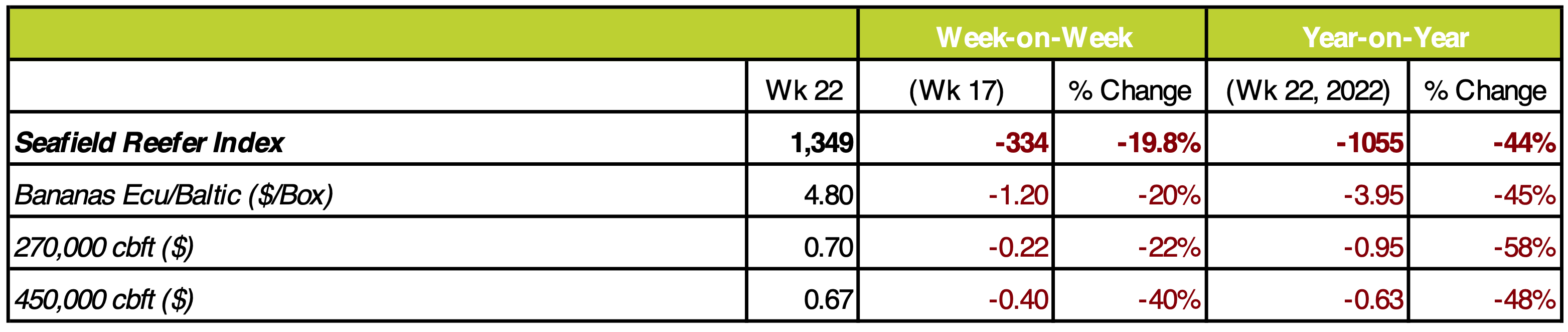

Market pressures finally came to bear on the reefer trades during May, as flagging imports of key commodities combined with aggressive price competition between liner operators saw freight levels nudged off a cliff, leaving our ISB Seafield Reefer Index down 20% across the month, at a two-year low of 1,349 points.

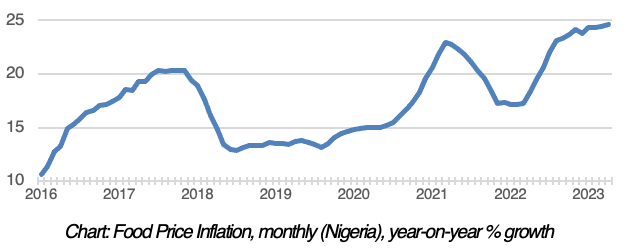

Fortunes for small- to mid-sized reefers have closely tracked the slowdown in fish trades into West Africa, which have been the crucial factor in winder plummeting rates. Nigeria – the most significant importer in West Africa – has suffered months of political and currency instability and the economies woes have borne out in higher food price inflation (up 25% year-on-year leading in to May) which has hit consumer purchasing power and left coldstores struggling to clear inventory. Indeed, the issue is wider spread than just Nigeria, with key importers such as Ghana, Ivory Coast and Cameroon similarly struggling to clear coldstore space, leaving an abundance of the Faroes Blue Whiting catch congesting coldstores in the North Continent as sellers struggle to shift bulk volumes.

Larger reefers similarly have dropped-off from a position of near-balance, with contract volumes easing and the scheduling of dry-dockings and repairs unable to stave-off a slide in freight levels as Operators were forced to track the aggressive price competition between container lines. For much of the past two years, the upheaval created by out-of-position reefer boxes had been arguably the major factor in rate surges for larger reefer vessels, peaking 12 months ago. However, as the equipment positing and supply rebalances the container lines have begun a price war between themselves to regain lost volumes, with conventional reefer tonnage caught in the fallout. Were it not for the increased dominance of Cool Carriers and Seatrade on trades into St. Petersburg following the exit of many of the major container lines, reefer rates in the fresh trades would probably be falling at a far greater pace considering the lower demand seen from Kiwi fruit this season as well as the anaemic demand for spot banana fixtures.

Outlook:

The immediate effect of the market’s bearish position, and outlook, is the steady planning of a summer lay-up schedule as Operators across the board assess how best to manage over-capacity which looks set to plague the market well into Autumn. It is also likely that many of the older, larger work-horses in the fleet will slowly transition to the demolition yards after a two-year hiatus. Fish trades meanwhile have a glum outlook, as market participants paint a bleak picture for the remainder of 2023. Much will hinge on policies of the new Nigerian government to curb inflation with cargo remaining at the ready.

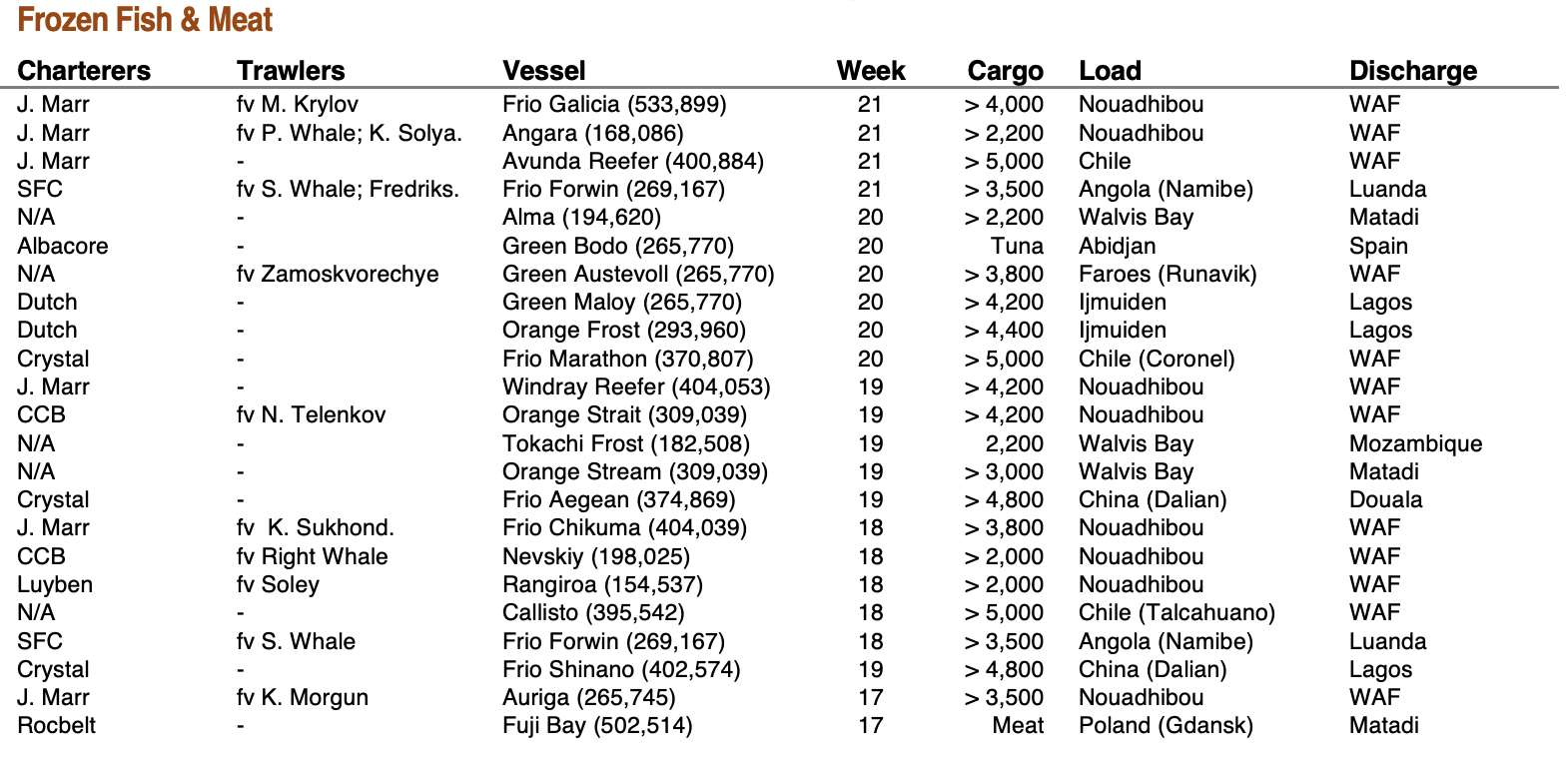

Select Fixtures from Wk 17-22:

Seafield Reefer Index

270,000 cu.ft. TCE returns